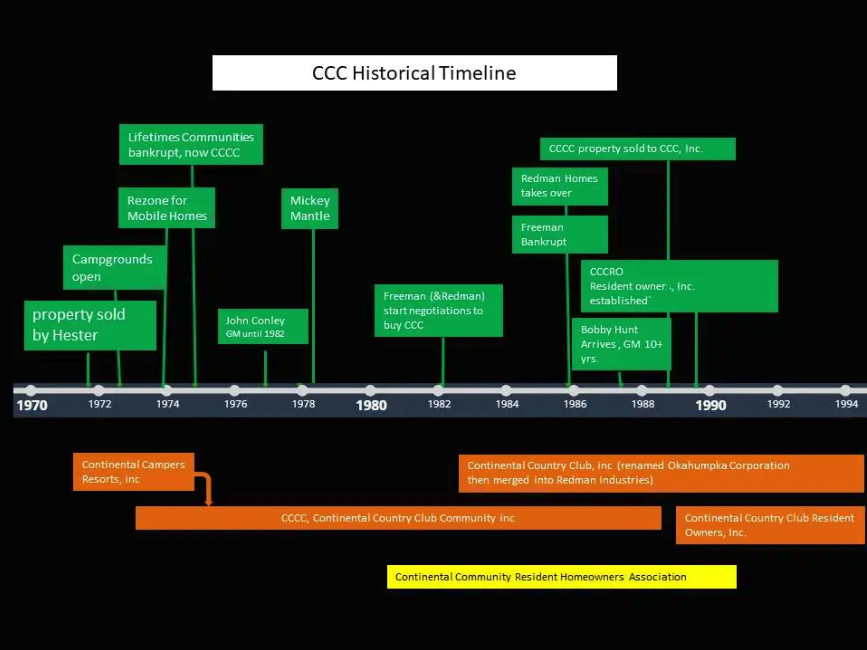

CCC Financial Troubles 1972-

According to the Wall Street Journal, some campgrounds resemble small towns, and investments run into millions of dollars. A facility near Wildwood, Fla. will open next month with 1150 campsites, and plans call for 1900 sites by the end of the year. "On a full day it will have a population upwards of 3000 people" says George Wayson, president of Continental Camper Resorts Inc., which owns the facility. The company's investment will total nearly $6 million.

Ref: hint of new continental campgrounds 1971

Page 24

Prevo said Wayson may have suffered some losses in his RV concept, but he had wins when he developed the clubhouse, tennis courts and the rest of the amenities.

Wayson ran into financial difficulties and Hershel Smith took over management when a company called “Lifetimes” bought the property. Jim Helms, a native Floridian with a degree in business administration, was hired as manager of the club and restaurant.

In 1973-74 Smith re-zoned for mobile home living to move in.

In 1974, Lifetimes took Chapter 11 after a valiant attempt to raise capital, It didn't work and the property was sold in a merger on December 6, 1974, and the name was changed to Continental Country Club Community. The merger was possible because Hershel Smith, James Lackey and other investors formed the new company on December 16, 1974, with Lackey as its first president.

Page 31

Conley, who now lives in Deland, explained that Fidelity Mortgage Investors first arrived as a lender for George Wayson, and after Wayson’s departure, hired Conley on November 29, 1976, to “clean up the mess”.

From 1976 to 1982, he paid off the debts previously incurred and replaced employees who were not accountable, efficient and trustworthy. When Fidelity started coming out of bankruptcy in 1981, the firm began to look for someone to buy Continental, which Freeman did. Conley said he left because he had accomplished his task of creating a viable business enterprise so Fidelity (Lifetimes) could sell.

Ref: Continental Ladies Club history 1994

In February 1982 Redman Homes (a subsidiary of Redman Industries) and Donald W. Freeman entered into negotiations that lead to Redman loaning Freeman $2,750,000.00 so that Freeman could purchase the Continental property from Continental Country Club Communities, Inc., and further develop it. Freeman was to obtain future development loans from sources other than Redman. During this time Freeman was purchasing manufactured homes from Redman and Redman had to advance more money to keep Freeman in business. Freeman also had obtained other loans from other lenders and each time Redman had been asked to subordinate it's loan to the new lender's loan.

Redman had done this several times in order to keep Freeman in business. In September 1983 Freeman borrowed $2.75 million from Southeast Bank, N.A. and Redman subordinated to the Southeast Bank loan.

In April of 1984 Freeman borrowed $2.15 million from Florida Federal Savings and Loan Assn. and again Redman subordinated to this loan. In August or September of 1984 Florida Federal Savings and Loan Assn. gave a conditional commitment to make a loan to Freeman for $7.36 million and Redman was asked to subordinate their loan again. Redman was not agreeable to this but did pay $380,000.00 to the State of Florida for Freeman's unpaid sales tax in order to avoid having the State file a tax lien against all property owned by Freeman.

In early February 1985, Redman conducted a partial investigation of Freeman's books and records and decided not to subordinate to the Florida Federal loan and on February 12, 1985 Freeman filed the Chapter 11 bankruptcy petition.

If Redman had let the bankruptcy action proceed without doing anything Redman could have lost most of the money it had loaned to Freeman. Instead of allowing this to happen, Redman filed a plan to take Continental out of bankruptcy. On March 24, 1986 Redman filed a second plan for reorganization with the U.S. Bankruptcy Court, Orlando Division, which was later amended and approved. At this point in time Redman Homes took over Continental Country Club. And from this date on, Redman was interested in selling the property to recover the funds that it had advanced.

Ref: purchase of continental country club